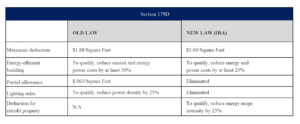

These changes are attractive because the Inflation Reduction Act reduces the energy efficiency standard from 50% to 25% while increasing the tax deduction amount from $1.88 per square foot to $5 per square foot. Simply put; if builders can make a building use 50% less energy and power, they can now get a tax deduction of $5.00 per square foot. For those of you who know real estate this is substantial; click the chart below to view changes.

How Is Section 179D Tax Deduction Calculated?

Builders receive a maximum deduction of $5.00 per square foot if they manage to cut their yearly energy expenses in half across all three systems (heating, cooling, and electricity). To be eligible for this benefit, they must adhere to prevailing wages and apprenticeship requirements.

If prevailing wages and apprenticeship are Not met, a sliding scale is used from $0.50 per square foot for energy savings of 25%, and up to $1.00 per square foot for energy savings of 50%.

This pivotal legislation holds the potential to reshape investment strategies and amplify investor returns.

Here’s why real estate investors care:

- Stability Amidst Economic Flux

Investors find reliable income streams and value appreciation in a market poised for resilience.

- Favorable Regulatory Climate

Investors stand to benefit from potential tax breaks and streamlined approval processes -influencing the rate of return.

- Growing Rental Demand

Multifamily properties are aligning perfectly with shifting housing preferences. Rising demand for rental housing is foreseen as people seek flexible living arrangements.

Invest with foresight, navigate with strategy, and reap rewards in South Florida’s multifamily market.